FintechZoom BAC Stock – A Comprehensive Guide

Investing in FintechZoom BAC Stock requires a solid understanding of market behavior and the financial data that drives investment decisions.

This article will delve into the performance of Bank of America Corporation (BAC) shares, leveraging insights from FintechZoom.

By the end of this guide, you will be equipped with the knowledge needed to make informed investment decisions regarding BAC stock.

Introduction

In the fast-paced world of finance, understanding stock performance is critical for making educated investment decisions. This article focuses on FintechZoom BAC stock, offering insights and analysis that can guide both new and seasoned investors.

By interpreting the data available through FintechZoom BAC Stock, we will explore how BAC stocks have performed over time and what factors might influence their future trajectory.

What is FintechZoom?

FintechZoom BAC Stock is a comprehensive financial news platform that offers insights into various sectors, including stocks, crypto currencies, and fintech innovations. It aggregates data, news, and analysis, making it a valuable resource for investors looking to stay informed.

By focusing on stocks like Bank of America (BAC), FintechZoom BAC Stock helps users understand market dynamics and make strategic investment decisions.

Overview of Bank of America Corporation (BAC)

Bank of America Corporation is one of the largest financial institutions in the United States, providing a wide array of banking and financial services.

Founded in 1904, FintechZoom BAC Stock has grown to become a leading player in investment banking, wealth management, and consumer banking. Understanding its position in the market is crucial for evaluating its stock performance.

Key Facts about BAC

- Ticker Symbol: BAC

- Headquarters: Charlotte, North Carolina

- Market Capitalization: Approximately $200 billion (as of October 2024)

- Core Services: Retail banking, investment banking, asset management, and wealth management.

Read More: Saphıre – Beauty, Types, and Significance

BAC Stock Performance Analysis

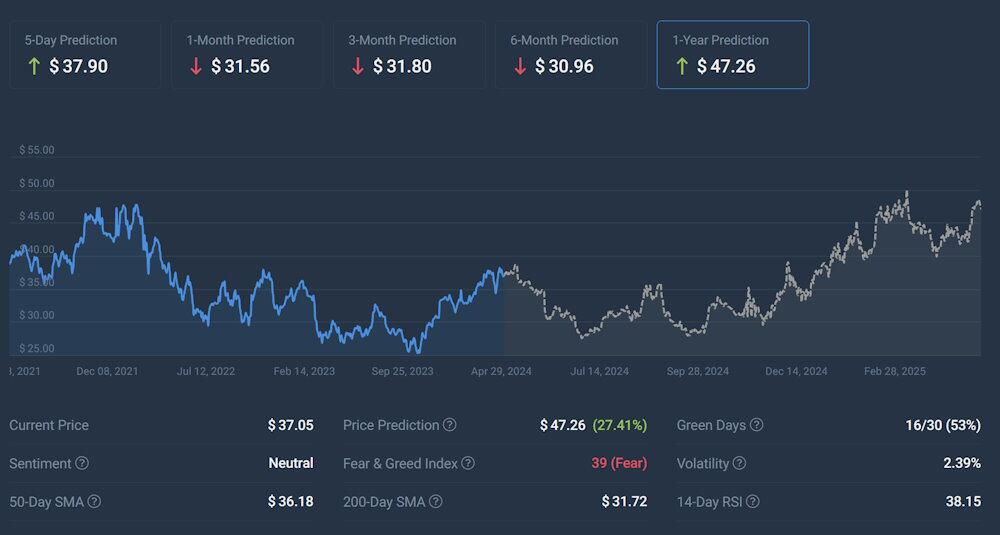

To assess the investment potential of FintechZoom BAC Stock, it’s essential to analyze its performance over time. This section provides a detailed look at both historical performance and recent trends, focusing on data sourced from FintechZoom.

Historical Performance

Historically, FintechZoom BAC Stock has seen significant fluctuations, mirroring broader trends in the banking industry and the economy at large. Here’s a look at some key milestones:

- 2008 Financial Crisis: BAC was heavily impacted during the financial crisis but managed to recover in the following years.

- 2010s Recovery: The stock price steadily climbed as the economy recovered, supported by rising interest rates and improving financial health.

- 2020 Pandemic Impact: Like many financial institutions, BAC faced challenges during the COVID-19 pandemic but demonstrated resilience with strategic adaptations.

Recent Trends

- Strong Earnings Reports: Recent quarterly earnings have surpassed market expectations, reflecting robust performance in retail banking and investment services.

- Increased Dividend Payments: BAC has increased its dividend payouts, making it an attractive option for income-focused investors.

- Market Sentiment: Positive analyst ratings and increased buy recommendations have contributed to a bullish sentiment around BAC stock.

Key Factors Influencing BAC Stock

Understanding the elements that influence FintechZoom BAC Stock is crucial for making informed investment decisions. Here are some of the most significant factors:

Economic Indicators

- Interest Rates: BAC’s profitability is closely tied to interest rate fluctuations. Rising rates can lead to increased net interest income, benefiting the stock.

- Employment Rates: Higher employment levels contribute to increased consumer spending and borrowing, positively impacting BAC’s performance.

Banking Sector Trends

- Regulatory Changes: New regulations can impact how FintechZoom BAC Stock operates and its profitability. Investors must stay informed about potential legislative changes.

- Fintech Competition: The rise of fintech companies poses both a threat and an opportunity for traditional banks like BAC. Adapting to technological changes is crucial for sustaining market share.

Investment Strategies for BAC Stock

When considering an investment in FintechZoom BAC Stock, it’s essential to develop a strategic approach. Here are some recommended strategies:

- Long-Term Investment: FintechZoom BAC Stock has historically shown resilience, making it a viable option for long-term investors seeking growth.

- Dividend Reinvestment: Reinvesting dividends can accelerate growth, especially given FintechZoom BAC Stock recent dividend increases.

- Market Timing: Keep an eye on market trends and economic indicators to make informed buy or sell decisions.

FintechZoom’s Data Insights on BAC Stock

FintechZoom provides a wealth of data on BAC stock that can inform your investment strategy. Here are some insights:

- Stock Price Forecast: Analysts predict a range of outcomes based on current trends and economic indicators, with target prices suggesting potential growth.

- Comparative Analysis: FintechZoom allows users to compare BAC stock with other banking stocks, offering valuable insights into its relative performance.

Read More: Topamax Ruined My Life – A Comprehensive Guide to Understanding the Drug’s Side Effects and Impact

How does FintechZoom compare BAC stock to other financial institutions?

1. Performance Metrics

- Price-to-Earnings (P/E) Ratio: FintechZoom compares BAC’s P/E ratio with those of its competitors to evaluate how the market values the company’s earnings.

- Return on Equity (ROE): This metric helps assess how effectively a company uses its equity to generate profits. BAC’s ROE is compared against other major banks to gauge performance.

- Dividend Yield: FintechZoom analyzes BAC’s dividend yield relative to peers, which is crucial for income-focused investors.

2. Market Capitalization

- The platform compares the market capitalization of BAC with other leading banks, providing insight into its relative size and market dominance in the financial sector.

3. Growth Potential

- Earnings Growth Projections: FintechZoom looks at projected earnings growth rates for BAC and compares them with other financial institutions to assess future performance potential.

4. Risk Assessment

- Volatility Analysis: The comparison includes examining the stock volatility of BAC against its peers, helping investors understand the relative risk of investing in BAC stock.

5. Analyst Ratings

- FintechZoom aggregates analyst ratings and recommendations for BAC and its competitors, providing insights into market sentiment and expected performance.

6. Economic and Sector Trends

- The platform considers macroeconomic factors and sector trends that might impact BAC and other banks similarly, offering a broader context for performance comparison.

7. News and Events

- Current news, regulatory changes, and economic events impacting the banking sector are factored into the comparison to provide timely insights.

Conclusion

Investing in BAC stock presents an opportunity to benefit from the growth of one of America’s leading financial institutions. By leveraging data and insights from FintechZoom, investors can make informed decisions that align with their financial goals. Understanding the market dynamics, economic indicators, and sector trends is essential for navigating the investment landscape effectively.

FAQs

What is BAC stock?

BAC stock refers to shares of Bank of America Corporation, a major financial services company in the U.S.

How has BAC stock performed historically?

BAC stock has experienced fluctuations, particularly during the 2008 financial crisis, but has shown resilience and growth since then.

What factors influence BAC stock prices?

Key factors include interest rates, economic indicators, regulatory changes, and competition from fintech companies.

Is BAC a good long-term investment?

Many analysts consider BAC a solid long-term investment, particularly due to its strong market position and dividend payments.

Where can I find data on BAC stock?

Websites like FintechZoom provide detailed data, analysis, and news related to BAC stock performance.

What is the current dividend yield for BAC?

As of October 2024, BAC has a dividend yield of approximately 2.5%.

How does FintechZoom help investors?

FintechZoom offers real-time data, news, and analysis, helping investors make informed decisions based on current market conditions.

What are the risks associated with investing in BAC stock?

Risks include economic downturns, regulatory changes, and competition from fintech firms.

What is the outlook for BAC stock in the coming years?

Analysts predict moderate growth based on economic recovery and strong earnings potential.

Can I trade BAC stock through any brokerage?

Yes, BAC stock can be traded through most online brokerage platforms.

Read More:

- Lilli Kay – Rising Star and Key Role in Yellowstone

- Jalynn Elordi – The Rising Star and Hidden Gem in Entertainment

- JoinPD.cpm – Your Ultimate Guide to Joining and Using Pear Deck for Interactive Lessons